Is It Really Better To Rent Than To Own a Maryland Home Right Now?

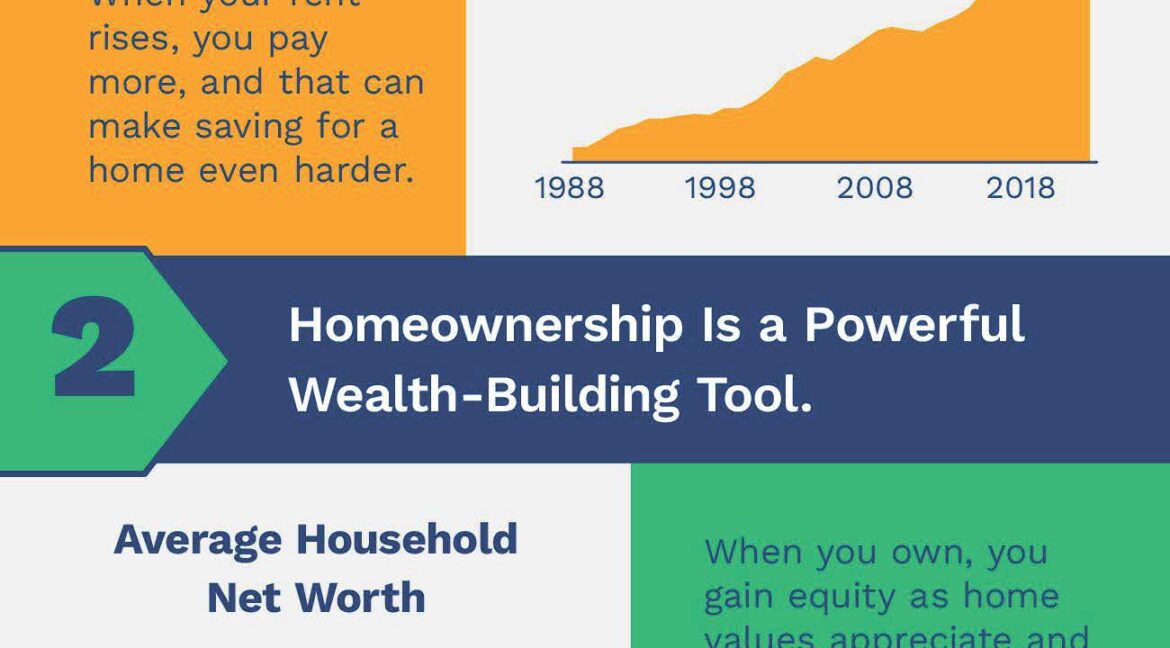

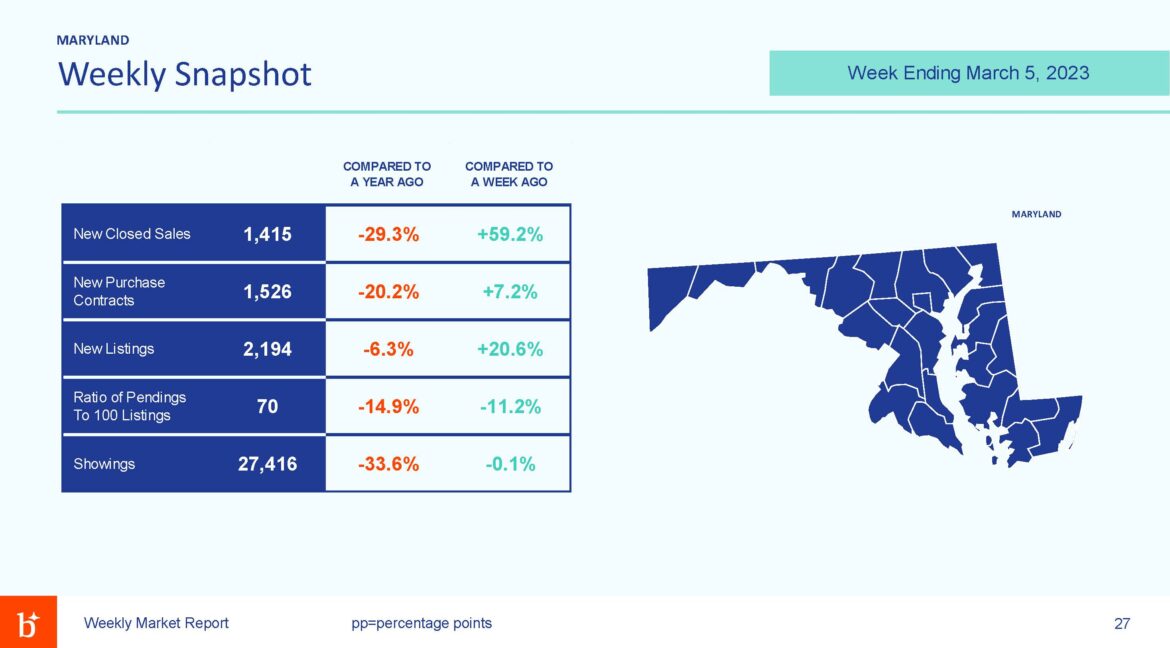

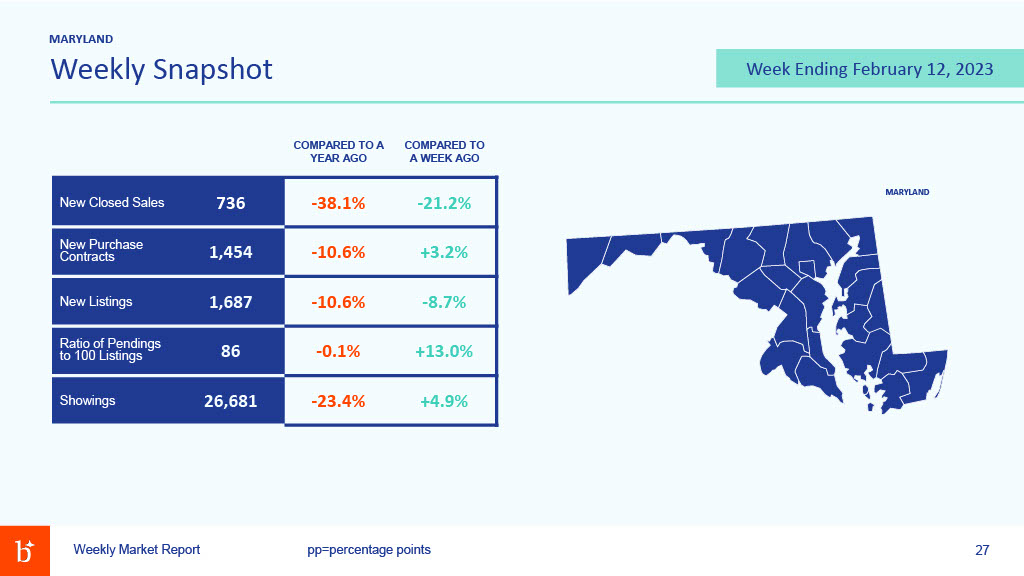

Is It Really Better To Rent Than To Own a Maryland Home Right Now? You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on. A lot…